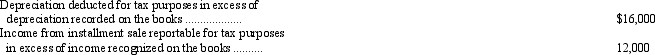

The books of the Tracker Company for the year ended December 31, 2011, showed pretax income of $360,000. In computing the taxable income for federal income tax purposes, the following timing differences were taken into account:

What should Tracker record as its current federal income tax liability at December 31, 2011, assuming a corporate income tax rate of 30 percent?

Definitions:

Eradication Of Poverty

The process or policy aimed at eliminating or significantly reducing poverty and its related conditions from a society or globally.

Regressive Taxes

Taxation that takes a larger percentage from low-income earners than from high-income earners.

Gender-Related Tax Breaks

Tax policies that provide advantages to taxpayers based on their gender, often aimed at promoting gender equality or supporting families.

Class Consciousness

Refers to being aware of membership in a class.

Q6: Which of the following is not an

Q8: Statement of Financial Accounting Standards No. 160,

Q21: Which of the following depreciation methods applies

Q28: Daniels Company reported sales of $800,000, bad

Q36: Of the following, select the incorrect statement

Q37: Which of the following isnot a component

Q45: An accrued expense can be described as

Q50: What would be the effect on book

Q52: The vested benefits of an employee in

Q101: The most conceptually appropriate method of valuing