Multiple Choice

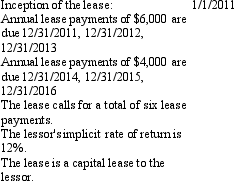

A lease agreement included the following provisions:

How much interest revenue is recognized in 2011 by the lessor, assuming a calendar-year fiscal year?

Definitions:

Related Questions

Q4: Landrover, Inc. had 150,000 shares of common

Q5: RCM Corporation, a calendar-year firm, is authorized

Q16: On June 30, 2011, Country Inc. had

Q20: Changes in fair value of securities are

Q31: In January 2011, Vance Mining Corporation purchased

Q41: Marshall, Inc., leased equipment to Gadsby Company

Q42: The Financial Accounting Foundation oversees the<br>A) operations

Q51: State Repairs acquires equipment under a noncancelable

Q69: Jones Corporation pays its employees monthly. The

Q75: On January 1, 2011, Eden Ventures, Inc.,