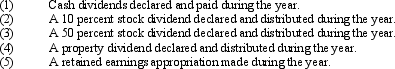

Indicate how each of the following transactions would be reflected in a statement of cash flows:

Definitions:

Cash Dividends

Payments made by a corporation to its shareholders from its profits in the form of cash.

Prepaid Expenses

Costs paid for in advance of receiving the benefit of the service or product, such as insurance premiums or rent, which are recorded as assets until used.

Income Taxes Payable

The amount of income taxes a company or individual owes to the government, which has not yet been paid.

Statement Of Cash Flows

A financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents.

Q12: Ignoring income taxes, choose the correct response

Q23: Hazard Inc. manufactures equipment that is sold

Q38: On December 1, 2011, Blake Inc. signed

Q46: Cardinal Industries computed a pretax financial income

Q57: The total interest expense on a $200,000,

Q59: As independent (or external) auditors, CPAs are

Q72: Once the FASB has established an accounting

Q75: On January 2, 2011, Worley Co. issued

Q80: Gooden Enterprises Inc. developed a new machine

Q82: When treasury stock is purchased for cash