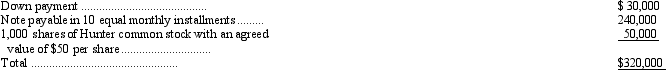

In January, Hunter Corporation entered into a contract to acquire a new machine for its factory. The machine, which had a cash price of $300,000, was paid for as follows:

Prior to the machine's use, installation costs of $8,000 were incurred. The machine has an estimated useful life of ten years and an estimated salvage value of $10,000. What should Hunter record as depreciation expense for the first year under the straight-line method?

Definitions:

Muslim World

Refers to countries and regions where Islam is the dominant or significant religion, encompassing a diverse range of cultures and societies.

War on Terror

A global military campaign launched by the United States in response to the September 11, 2001 terrorist attacks, aimed at eliminating terrorist groups and their supporters.

Saddam Hussein

The fifth President of Iraq, serving from 1979 until 2003, known for his authoritarian regime, involvement in multiple wars, and eventual overthrow by a U.S.-led coalition.

Religious Fundamentalists

Individuals or groups with strict adherence to specific religious doctrines, often associated with conservative or literal interpretations of sacred texts.

Q5: Medium-security prisons operate without armed guards or

Q8: Statement of Financial Accounting Standards No. 160,

Q13: Wallace, Inc., loaned Grommit Company $40,000 on

Q22: Basic Technology Corporation has a noncontributory, defined-benefit

Q47: Explain the fundamentals of Miranda v.Arizona,what happens

Q57: When a company replaces an old asphalt

Q61: Wilbur Company acquired Smith Company on January

Q66: Which of the following is not a

Q68: Which goal of punishment is aimed at

Q85: Trade secrets are an example of which