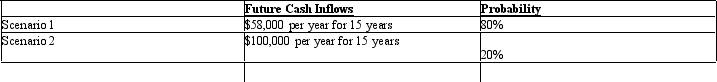

Anaconda Mining Company has a copper mine in Nevada operating at a reduced level of production for the past two years. The market for copper has been adversely affected by weak prices, low demand, and foreign competition. Management believes that the market likely will improve next year and does not plan to abandon this facility. Nevertheless, the controller of the company plans to test the plant and equipment of the operation for impairment due to the decrease in its use. The plant and equipment used in this operation were acquired five years ago for $1,600,000 and have been depreciated using straight-line depreciation over a 20-year life with no residual value. The controller estimates that the assets have a remaining useful life of 15 years and that the following two cash flow scenarios are possible, with the indicated probabilities:

The fair value of the plant and equipment is estimated to be $890,000.

Prepare the entry (if any) required to recognize the impairment loss.

Definitions:

Q10: Any gains or losses from the early

Q14: Each component of the criminal justice system

Q18: According to the restorative justice model,what is

Q30: The lessee's balance sheet liability for a

Q32: Stockton, Inc. leased machinery with a fair

Q42: How would the declaration of a liquidating

Q47: Which of the following arguments is supportive

Q72: UR Company purchased a customer database and

Q76: Order backlogs are an example of which

Q103: At December 31, 2011, Reed Corp. owed