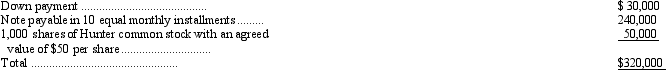

In January, Hunter Corporation entered into a contract to acquire a new machine for its factory. The machine, which had a cash price of $300,000, was paid for as follows:

Prior to the machine's use, installation costs of $8,000 were incurred. The machine has an estimated useful life of ten years and an estimated salvage value of $10,000. What should Hunter record as depreciation expense for the first year under the straight-line method?

Definitions:

Valid

The state of being logically or legally sound; having force, or binding force; effectively supporting a specified point or claim.

Variable

A characteristic or attribute that can vary or be changed, often used in research to measure or test hypotheses.

Indicators

Quantitative or qualitative factors that provide a measure of some aspect of a society's condition or progress, often used in research and policy analysis.

Well-Being

A state of health, happiness, and prosperity.

Q4: Which of the following measurement attributes is

Q28: Explain the meaning of,"the criminal justice system

Q45: A company declared a cash dividend on

Q55: The annual interest expense on a $50,000,

Q63: The market rate of interest for a

Q66: The result of interperiod income tax allocation

Q71: Recording the purchase price of a pencil

Q74: At the beginning of the year a

Q79: Probation usually involves the _ of an

Q79: Members of the Financial Accounting Standards Board