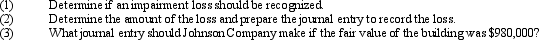

Johnson Company is located in Hong Kong and uses international accounting standards. Johnson Company purchased equipment 8 years ago for $1,000,000. The equipment has been depreciated using the straight-line method with a 20-year useful life and 10% residual value. Johnson's operations have experienced significant losses for the past 2 years and, as a result, the company has decided that the equipment should be evaluated for possible impairment. The management of Johnson Company estimates that the equipment has a remaining useful life of 7 years. The discounted value of the future net cash inflows from the use of the equipment is $220,000. The fair value of the equipment is $240,000. No goodwill was associated with the purchase of the equipment. Johnson Company has chosen to recognize increases in the value of long-term operating assets in accordance with the allowable alternative under IAS 36.

Definitions:

Field Names

Field names are the titles or headings given to columns or elements in a database or spreadsheet, indicating the type of data they contain.

Square Brackets

The symbols [ and ] used to enclose words or numbers for various purposes, such as clarifications within text or referencing.

Periods

These are punctuation marks used to denote the end of a sentence or a decimal point in numbers.

Navigation Pane

A user interface element that allows users to easily browse and manage the structures of documents, files, or databases.

Q6: WM is a waste disposal company. Explain

Q17: On April 1, 2011, Ziba Inc. purchased

Q22: Felons are usually incarcerated in a federal

Q23: Undistributed stock dividends should be reported as<br>A)

Q24: Financial statements should provide information that is

Q26: Tricking others into harassing or threatening a

Q27: The rehabilitation model suggests that people commit

Q29: The judge represents the state in criminal

Q30: Gains and losses on the purchase and

Q56: For a capital lease, the amount recorded