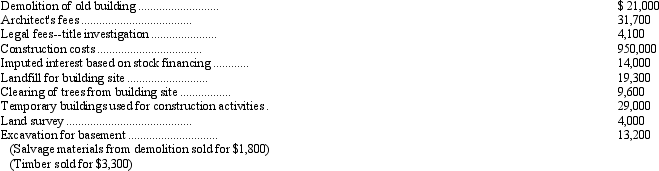

On February 1, 2010, Reardon Corporation purchased a parcel of land as a factory site for $320,000. An old building on the property was demolished and construction begun on a new warehouse that was completed April 15, 2011. Costs incurred on the construction project are listed below.

Determine the cost of the land and new building.

Definitions:

Unrealized Gains

Profits that have been achieved on paper from investments but have not yet been sold for cash, and therefore are not reflected in the income statement.

Stockholders' Equity

The residual interest in the assets of a corporation after deducting its liabilities, representing ownership interest.

Fair Value Adjustment

An accounting process to adjust the book value of assets or liabilities to their current market value, often for financial reporting purposes.

Consolidated Balance Sheet

A financial statement that aggregates the financial position of a parent company and its subsidiaries, presenting the assets, liabilities, and equity of the entire group as if it were a single entity.

Q14: The following amounts were taken from the

Q20: Changes in fair value of securities are

Q21: Primary responsibility for GAAP and public reporting

Q25: Foster Corporation issued a $100,000, 10-year, 10

Q38: On July 1, 2011, The Woodward Group

Q68: Within the multi-tiered court structures of most

Q75: Marburg Manufacturing Company purchased a machine on

Q95: On January 1, 2011, Felipe Hospital issued

Q99: Accrued interest on bonds that are sold

Q100: On January 1, 2011, Williams Company lent