UR Company purchased a customer database and a formula for a new fuel substitute for diesel fuel for a total of $100,000. UR Company uses the expected cash flow approach for estimating the fair value of these two intangibles. The appropriate interest rate is 5%. The potential future cash flows from the two intangibles, and their associated probabilities, are as follows:

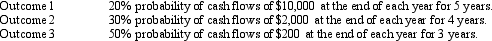

Customer Database:

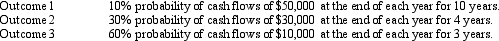

Formula:

Prepare the journal entry necessary to record the purchase of the two intangibles.

Definitions:

National Saving

The total amount of savings generated within a country, typically calculated as the sum of private and public savings after accounting for investments and budget deficits.

Interest Rate

The percentage of a loan amount charged by the lender to the borrower for the use of assets, usually expressed as an annual percentage rate.

Net Capital Outflow

A contrast in the buying of foreign assets by residents of a country and the acquisition of its assets by non-residents.

NCO Curve

A hypothetical graphical representation that could relate to issues in international economics or capital flows, but requires clearer context for an accurate definition.

Q9: Jazz Company acquired land and paid for

Q19: On December 31, 2011, the stockholders' equity

Q23: Undistributed stock dividends should be reported as<br>A)

Q26: A firm purchased bonds to be classified

Q30: A company using the group depreciation method

Q34: Advocates of the crime control model do

Q37: Police and other law enforcement agents are

Q55: The product that results from the creation

Q69: The following transactions relate to the stockholders'

Q70: The following information pertains to Rondo Corp.