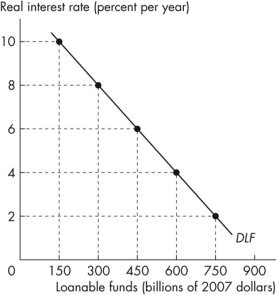

Refer to the figure below to answer the following questions.

Figure 7.2.3

Figure 7.2.3

-In Figure 7.2.3, the real interest rate is 6 percent a year and the economy is on curve DLF.The expected profit rises.With no change in the real interest rate, the new quantity of loanable funds demanded is

Definitions:

Risk Premium

The extra return expected by investors for taking on a higher level of risk compared to a risk-free investment.

Market Return

The total return from investing in a market or an index, including dividends, interest, and capital gains.

Risk-Free Rate

The theoretical return on an investment with zero risk, typically associated with government bonds.

Security's Beta

A measure of a stock's volatility in comparison to the overall market; a beta greater than 1 indicates higher volatility than the market, while a beta less than 1 indicates lower volatility.

Q12: In Table 3.4.1, the equilibrium quantity is<br>A)420

Q28: Refer to Figure 3.4.2.When the price is

Q42: If the current growth rate of real

Q46: The reference base year is 2017. To

Q56: Lev Vygotsky's theory focuses on<br>A)critical periods of

Q78: In Figure 9.3.1, suppose the demand for

Q79: Which of the following would be an

Q84: Canada's economic growth rate was highest in

Q93: Choose the incorrect statement.<br>A)When the quality of

Q99: Wages, salaries, and supplementary labour income are