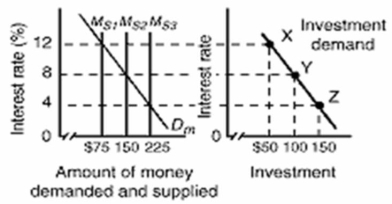

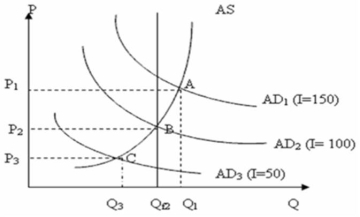

Refer to the graphs below.The first graph shows the money market of an economy, and the second graph shows the market for goods and services in the economy.

In the above diagrams, the numbers in the parentheses after the AD1, AD2, and AD3 labels indicate the levels of investment spending associated with each AD curve.All figures are in billions.Qf is the full-employment level of real output.The interest rate in the economy is 4 percent.Which of the following should the monetary authorities do to achieve a non-inflationary full-employment level of real GDP?

In the above diagrams, the numbers in the parentheses after the AD1, AD2, and AD3 labels indicate the levels of investment spending associated with each AD curve.All figures are in billions.Qf is the full-employment level of real output.The interest rate in the economy is 4 percent.Which of the following should the monetary authorities do to achieve a non-inflationary full-employment level of real GDP?

Definitions:

Pre-Tax Cost of Debt

The rate of return that a company pays on its debt before taking into account taxes.

Weighted Average Cost of Capital (WACC)

The average rate of return a company is expected to pay its security holders to finance its assets, weighted by the proportion of equity and debt in the company's capital structure.

Coupon Rate

The rate of interest a bond pays annually, expressed as a percentage of its nominal value.

Dividend Growth Rate

The annualized percentage rate of growth of a company’s dividend payout, indicating the stability and growth prospects of the company to investors.

Q7: The following balance sheet is for the

Q20: The estimated value of all financial assets

Q21: The bank rate is the interest rate

Q26: Which of the following statements is true

Q44: You estimate that a piece of real

Q60: (Consider This) According to critics, growth in

Q114: The smallest component of the money supply

Q164: Which of the following is a popular

Q171: When government tax revenues change automatically and

Q234: Monetary policy is:<br>A)faster than fiscal policy.<br>B)slower than