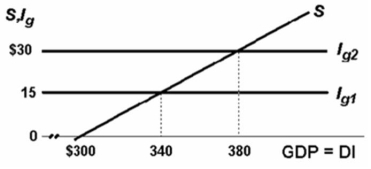

Refer to the above diagram which is for a private closed economy.All figures are in billions of dollars.If businesses were willing to invest $30 at each possible level of GDP, the equilibrium level of GDP would be:

Refer to the above diagram which is for a private closed economy.All figures are in billions of dollars.If businesses were willing to invest $30 at each possible level of GDP, the equilibrium level of GDP would be:

Definitions:

True Risk

The actual level of risk associated with an investment or decision, considering all factors including unknowable future events.

Systematic Risk Principle

Principle stating that the expected return on a risky asset depends only on that asset’s systematic risk.

Expected Return

The weighted average of all possible returns for an investment, with each return being weighted by its probability of occurrence.

CAPM

The Capital Asset Pricing Model, a theory that describes the relationship between systematic risk and expected return for assets, particularly stocks.

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q34: If the MPS is 1, the multiplier

Q48: Refer to the diagram below.Suppose that aggregate

Q68: In which of the following industries or

Q80: If aggregate expenditures exceed the domestic output

Q89: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" In the above

Q133: In a private closed economy _ investment

Q158: A decline in disposable income:<br>A)increases consumption by

Q207: In reality, if a nation imposes tariffs,

Q236: Other things equal, if $100 billion of