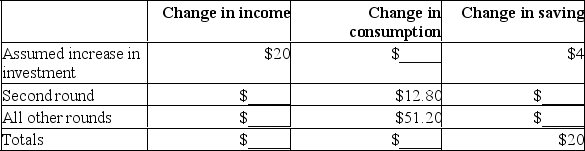

The following table illustrates the multiplier process in a private closed economy:  Refer to the above table.The multiplier in this economy is:

Refer to the above table.The multiplier in this economy is:

Definitions:

Progressive Tax

A taxation system where the tax rate increases as the taxable amount increases, typically leading to higher earners paying a larger percentage of their income than lower earners.

Tax

A compulsory financial charge or some other type of levy imposed on a taxpayer by a governmental organization in order to fund government spending and various public expenditures.

Proportional

Pertaining to a relationship where quantities change at the same rate, maintaining a constant ratio.

Taxable Income

The portion of an individual's or business's income used to determine how much tax will be owed to the federal government.

Q5: The level of aggregate expenditures in the

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q74: Most economists believe that the immediate cause

Q133: In determining real GDP economists adjust the

Q139: The wealth effect will tend to decrease

Q141: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q164: If real GDP is 50 and nominal

Q179: The following schedule contains data for a

Q181: The investment demand curve of an economy

Q194: Refer to the diagram given below. <img