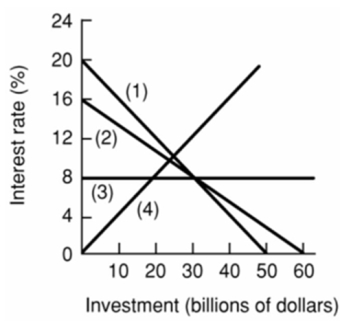

Assume that if the interest rate that businesses must pay to borrow funds were 20 percent, it would be unprofitable for businesses to invest in new machinery and equipment so that investment would be zero.But if the interest rate were 16 percent, businesses would find it profitable to invest $10 billion.If the interest rate were 12 percent, $20 billion would be invested.Assume that total investment continues to increase by $10 billion for each successive 4 percentage point decline in the interest rate.Refer to the above information.Which of the following is the correct graphical presentation of the indicated relationship?

Definitions:

Support Department Cost Allocation

The process of distributing indirect costs from support departments, such as Human Resources or IT, to operational departments or product lines.

Dual Cost Allocation

A method of cost allocation that involves assigning costs to two or more objects without arbitrarily dividing them.

Long-Run Average Usage

The average amount of a resource used over a prolonged period, reflecting consistent consumption patterns.

Dual Cost Allocation

An accounting method that assigns costs to two or more entities or projects, based on a predetermined formula or basis of apportionment.

Q2: If a nation's balance of payments is

Q6: What phase of the business cycle is

Q11: The following is the consolidated balance sheet

Q23: How can the aggregate demand curve be

Q51: What is the effect on the money

Q82: Which of the following economic systems are

Q103: Which of the following will not require

Q120: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q200: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q206: If the production possibilities curve is a