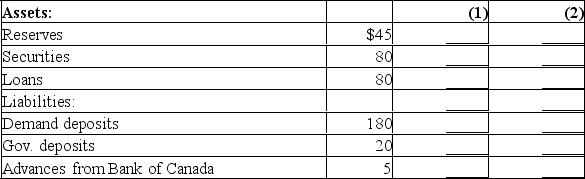

The following are simplified balance sheets for the chartered banking system and the Bank of Canada.Perform the two following transactions, (1) and (2), making appropriate changes in columns (1) and (2) in each balance sheet.Do not cumulate your answers.Also, answer these three questions for each part: (a) What change, if any, took place in the money supply as a direct result of this transaction? (b) What change, if any, occurred in chartered bank reserves? (c) What change occurred in the money-creating potential of the chartered banking system if the reserve ratio is 20%? All figures are in billions of dollars.Consolidated Balance Sheet: Chartered Banking System

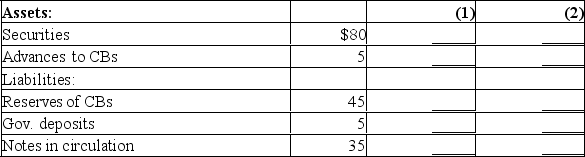

Consolidated Balance Sheet: Bank of Canada

Consolidated Balance Sheet: Bank of Canada

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional $2 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $3 billion of government bonds from the public.Show the new balance sheet figures in column 2.

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional $2 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $3 billion of government bonds from the public.Show the new balance sheet figures in column 2.

Definitions:

Rational Consumer

An assumption in economics that consumers aim to maximize their utility or satisfaction from consumption choices, given their budget constraints.

Cobb-Douglas Utility Function

A specific form of utility function used in economics to represent preferences, where utility is derived from a combination of goods, typically modeled with constants representing the elasticity of substitution between those goods.

Real Interest Rate

The interest rate that has been adjusted to remove the effects of inflation, reflecting the real cost of borrowing.

Consumption

The action of using up a resource or goods, often referring to the rate at which consumers purchase and use products and services.

Q12: In Douglas Adams' The Restaurant at the

Q13: Evaluate: "Pollution is undesirable.Therefore, all pollution should

Q16: What is a price ceiling and what

Q16: Suppose that a hypothetical economy has the

Q17: State three causes of the public debt.

Q24: Explain the term "laissez-faire capitalism.

Q66: An increase in demand for strawberries is

Q116: In drawing the production possibilities curve we

Q217: All of the following could immediately or

Q231: The typical production possibilities curve is:<br>A)an upward