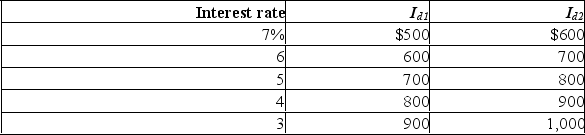

The table below gives data on interest rates and investment demand in a hypothetical economy.Figures are in billions.  (a) Use the Id1 schedule.Assume that the government needs to finance a budget deficit and this public borrowing increases the interest rate from 5% to 6%.How much crowding-out of private investment will occur?

(a) Use the Id1 schedule.Assume that the government needs to finance a budget deficit and this public borrowing increases the interest rate from 5% to 6%.How much crowding-out of private investment will occur?

(b) Now assume that the deficit is used to improve the performance of the economy, and that as a consequence the investment-demand schedule changes from Id1 to Id2.At the same time, the interest rate rises from 5% to 6% as the government borrows money to finance the deficit.How much crowding-out of private investment will occur in this case?

(c) Graph the two investment-demand schedules on the graph below and show the difference between the two events.Put the interest rate on the vertical axis and the quantity of investment demanded on the horizontal axis.

Definitions:

Voting Paradox

is a situation in social choice theory where collective preferences can be cyclic (A is preferred to B, B is preferred to C, and C is preferred to A), despite the individual preferences being consistent.

Majority-Rule Voting

A decision-making process where the option that receives more than half of the votes is chosen, commonly used in democratic systems and organizations.

Voting Paradox

A situation in social choice theory where collective preferences can be cyclic (i.e., not transitive), even if the preferences of individual voters are not, leading to a lack of consistent aggregation of individual preferences into a coherent group order.

Impossibility Theorem

A principle, also known as Arrow's impossibility theorem, stating that it is impossible to devise a social welfare function that fairly ranks societal preferences in the presence of three or more options.

Q1: Use the following data to answer the

Q3: The data in the first two columns

Q10: Compared to the long run aggregate supply

Q13: Evaluate: "Pollution is undesirable.Therefore, all pollution should

Q13: What are the five main liabilities of

Q15: Identify at least four transactions and other

Q26: The table below shows the price index

Q30: Assume a household would consume $100 worth

Q31: Show graphically the relationships that you would

Q50: The production possibilities curve illustrates the basic