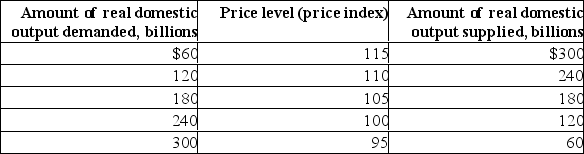

Suppose the aggregate demand and short-run aggregate supply schedules for a hypothetical economy are as shown below:

(a) What will be the equilibrium price and real output level in this hypothetical economy? Is this level of real GDP also the full-employment level of output? Explain.(b) Why won't a price level of 100 be the equilibrium price level? Why won't a price level of 110 index be the equilibrium price level?

(a) What will be the equilibrium price and real output level in this hypothetical economy? Is this level of real GDP also the full-employment level of output? Explain.(b) Why won't a price level of 100 be the equilibrium price level? Why won't a price level of 110 index be the equilibrium price level?

(c) Suppose aggregate demand increases by $120 billion at each price level.What will be the new equilibrium price and output levels?

(d) What factors might cause aggregate demand to increase?

(e) Suppose short-run aggregate supply increases by $120 billion at each price level.What will be the new equilibrium price and output levels?

Definitions:

Enzymes

Cellular molecules that considerably quicken the tempo of almost every chemical interaction taking place within cells.

Digestion

The breakdown of food into smaller components that can be absorbed and assimilated into the body.

Physiologist

A scientist who studies the functions and mechanisms of living organisms and their parts.

Anatomist

A scientist who specializes in the study of the structure of living things.

Q3: What is Okun's law? Give an example

Q3: Suppose the economy is experiencing inflation.Describe the

Q9: Why do economists worry about "multiple counting"

Q10: Economy growth matters? Either support or critic

Q19: Define the equilibrium level of output.

Q23: Suppose a producer sells 1,000 units of

Q27: What is producer surplus?

Q36: What is meant by the overnight lending

Q53: How does deterioration in the quality of

Q134: If the economy is in equilibrium at