Figure 10.2

Figure 10.2

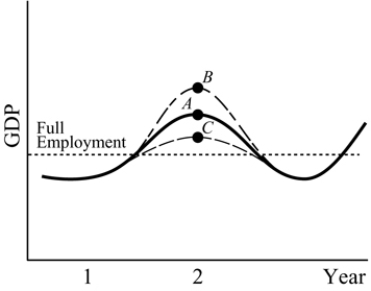

-Refer to Figure 10.2 to answer the question below. Points A, B, and C correspond to a GDP level in Year 2. Suppose that in Year 1 the economy was projected to be at Pt. A by Year 2. Which of the following policies could bring the economy to Point C instead?

Definitions:

AGI

Adjusted Gross Income, calculated as gross income minus specific adjustments, used to determine tax liability and eligibility for certain tax benefits.

Adoption Credit

A tax credit offered to adoptive parents to offset the costs of adoption, available under the U.S. tax code.

Modified AGI

Adjusted Gross Income with certain adjustments added back in, used for determining eligibility for certain tax deductions and credits.

Qualified Adoption Expenses

The necessary costs incurred during the process of legally adopting a child, which can be eligible for tax credits.

Q28: Broadly defined, investments are:<br>A) actions that create

Q62: According to the application, the reason why

Q65: The strength of the functional structure is

Q72: Refer to Table 11.6. In this example,

Q80: Project structures tend to be rigid and

Q83: What can provide a framework for understanding

Q89: The Kennedy administration endorsed substantial tax cuts

Q118: In what type of organizational structure is

Q196: Firms react to a unplanned positive inventory

Q245: Refer to Figure 11.1. For the economy