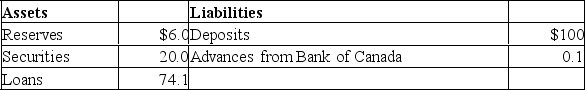

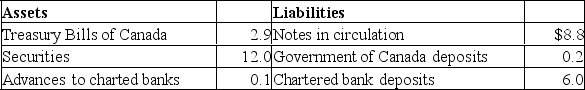

The following are simplified consolidated balance sheets for the chartered banking system and the Bank of Canada.Do not cumulate your answers; that is, do return to the data given in the original balance sheets in answering each question.Assume a desired reserve ratio of 5 percent for the chartered banks.All figures are in billions of dollars.CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM  BALANCE SHEET: BANK OF CANADA

BALANCE SHEET: BANK OF CANADA Refer to the above information.Suppose the Bank of Canada buys $2 in securities from the public.As a result of this transaction, the supply of money will:

Refer to the above information.Suppose the Bank of Canada buys $2 in securities from the public.As a result of this transaction, the supply of money will:

Definitions:

Transfer

The act of moving or conveying property, title, or rights from one entity or person to another.

Negotiable Instrument

A document in writing that ensures the payment of a certain sum of money, either when requested or at a predetermined date, with the document explicitly naming the individual responsible for payment.

Holder in Due Course

A party who has acquired a negotiable instrument in good faith and for value, and thus has certain protections against defects in the instrument and previous parties.

Payable on Demand

A financial term indicating that a debt or other financial obligation is due for payment as soon as the lender requests it.

Q4: A restrictive monetary policy reduces investment spending

Q19: Which of the following describes the fundamental

Q35: The buying and selling activities that tend

Q37: The vertical intercept of the Security Market

Q55: A contractionary fiscal policy in Canada which

Q80: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q82: A decline in the equilibrium level of

Q151: A portfolio of many different stocks and

Q175: If the government wishes to increase the

Q284: A bond that pays no annual interest