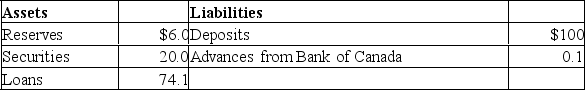

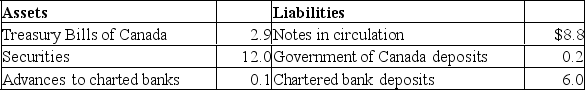

The following is a simplified consolidated balance sheet for the chartered banking system and the Bank of Canada.Assume a desired reserve ratio of 5 percent for the chartered banks.All figures are in billions of dollars.CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM  BALANCE SHEET: BANK OF CANADA

BALANCE SHEET: BANK OF CANADA Refer to the above information, suppose the Bank of Canada sells $2 in securities directly to the chartered banks.As a result of this transaction, the supply of money:

Refer to the above information, suppose the Bank of Canada sells $2 in securities directly to the chartered banks.As a result of this transaction, the supply of money:

Definitions:

Debt-To-Equity Ratio

A metric outlining the balance of shareholder equity and debt in the financial composition for supporting a company's assets.

Equity Multiplier

A financial leverage ratio that indicates the portion of a company's assets that are financed by shareholders' equity.

Net Profit Margin

A financial metric that shows the percentage of revenue remaining after all operating expenses, interest, taxes, and preferred stock dividends have been deducted from total revenue.

Gross Margin

The difference between sales revenue and the cost of goods sold, representing the profit before deducting operating expenses.

Q16: The main goal of a chartered bank

Q80: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q95: Assume the Standard Toy Company negotiates a

Q150: Which of the following is the most

Q162: In the Canadian economy, the money supply

Q199: Refer to the information below.If the money

Q199: Arbitrage refers to the buying and selling

Q229: The so-called risk-free rate essentially measures the

Q233: The effect of quantitative easing is to:<br>A)lowering

Q282: What concept describes how quickly an investment