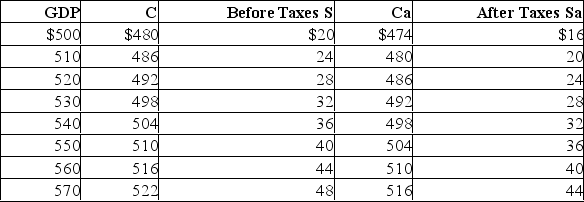

Refer to the above table.If an additional lump-sum tax of $20 were imposed, we would expect:

Refer to the above table.If an additional lump-sum tax of $20 were imposed, we would expect:

Definitions:

Variable Costs

Expenses that vary directly with the level of production or output, such as materials and labor costs.

Fixed Cost

Expenses that do not change with the level of production or sales, such as rent, salaries, and insurance.

Net Operating Income

A measure of a company's profitability, calculated by subtracting operating expenses from operating revenues, excluding taxes and interest.

EBIT

A financial performance metric that calculates a company's profits before accounting for interest and income tax costs, including all other expenses.

Q4: Assume that for the entire business sector

Q40: Suppose the full-employment level of real output

Q60: Per unit production cost is:<br>A)real output divided

Q65: The complexity in recognizing the type of

Q96: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q97: If government increases its purchases by $15

Q138: The multiplier effect:<br>A)reduces the MPC.<br>B)magnifies small changes

Q167: If an increase in aggregate expenditures results

Q174: Which of the following countries had the

Q195: The following information is for a private