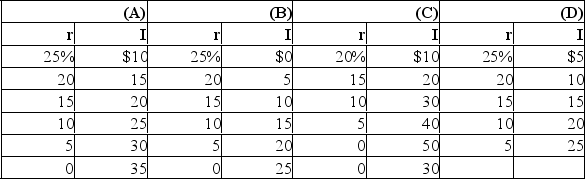

Assume there are no prospective investment projects (I) which will yield an expected rate of return (r) of 25 percent or more, but that there are $5 billion of investment opportunities with an expected rate of return between 20 and 25 percent, an additional $5 billion between 15 and 20 percent, and so on.The investment-demand curve for this economy is:

Definitions:

Q92: Refer to the data below.Personal income: All

Q121: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q127: Other things equal, if the real interest

Q155: If the Consumer Price index rises from

Q162: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q168: Given the expected rate of return on

Q171: If the unemployment rate is 9 percent

Q180: The following table illustrates the multiplier process

Q181: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q196: In a mixed open economy, where aggregate