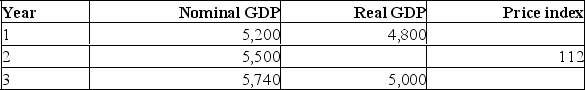

(GDP figures are in billions of dollars.)  Refer to the above table.What was real GDP in Year 2?

Refer to the above table.What was real GDP in Year 2?

Definitions:

Progressive Tax

Progressive tax is a taxation system where the tax rate increases as the taxable amount or income increases, placing a higher burden on those with higher incomes.

Average Tax Rate

The ratio of the total amount of taxes paid to the total tax base (taxable income or spending), essentially reflecting the percentage of income that is paid in taxes.

Marginal Tax Rate

The rate at which the next dollar of taxable income is taxed.

Taxable Income

The amount of an individual's or entity's income used as the basis for calculating how much tax they owe to the government, after deductions and exemptions.

Q3: The term "productive efficiency" refers to:<br>A)the situation

Q13: By summing the dollar value of all

Q33: Gross investment refers to:<br>A)private investment minus public

Q42: A well-functioning financial system helps to promote

Q58: According to the paradox of voting:<br>A)public goods

Q75: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q83: Between 1946 - 2011, the annual Canadian

Q109: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q112: GDP excludes expenditures by:<br>A)businesses on pollution control

Q157: An economist predicts that in a bicycle