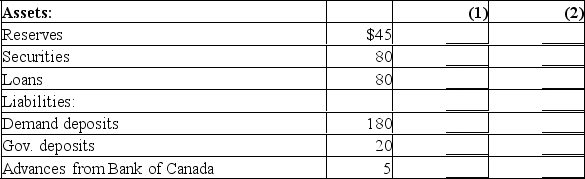

The following are simplified balance sheets for the chartered banking system and the Bank of Canada.Perform the two following transactions, (1) and (2), making appropriate changes in columns (1) and (2) in each balance sheet.Do not cumulate your answers.Also, answer these three questions for each part: (a) What change, if any, took place in the money supply as a direct result of this transaction? (b) What change, if any, occurred in chartered bank reserves? (c) What change occurred in the money-creating potential of the chartered banking system if the reserve ratio is 20%? All figures are in billions of dollars.Consolidated Balance Sheet: Chartered Banking System

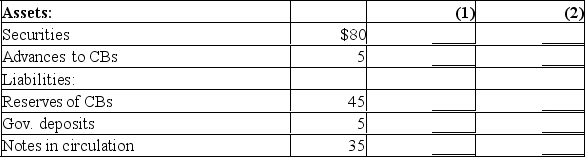

Consolidated Balance Sheet: Bank of Canada

Consolidated Balance Sheet: Bank of Canada

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional $2 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $3 billion of government bonds from the public.Show the new balance sheet figures in column 2.

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional $2 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $3 billion of government bonds from the public.Show the new balance sheet figures in column 2.

Definitions:

P-chart

A control chart variant employed in statistical quality management for tracking the percentage of defective products in a procedure as time progresses.

Variable Sample Size

A sampling method where the size of the sample can change based on the experiment or study being conducted.

Standard Deviation

A measure of the amount of variation or dispersion of a set of values.

Q3: Why does aggregate demand shift outward by

Q4: Explain the effect of an increase in

Q6: Evaluate the argument: "Restricting imports from other

Q9: Assuming no government intervention, describe the market

Q18: Explain the difference between planned and actual

Q30: Evaluate the statement: "Inflation only benefits the

Q51: How does the public debt contribute to

Q114: The price ratio of the two products

Q153: Which of the following statements is not

Q256: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" In the above