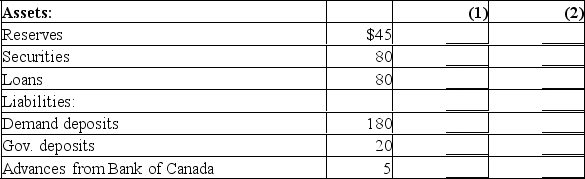

The following are simplified balance sheets for the chartered banking system and the Bank of Canada.Perform the two following transactions, (1) and (2), making appropriate changes in columns (1) and (2) in each balance sheet.Do not cumulate your answers.Also, answer these three questions for each part: (a) What change, if any, took place in the money supply as a direct result of this transaction? (b) What change, if any, occurred in chartered bank reserves? (c) What change occurred in the money-creating potential of the chartered banking system if the reserve ratio is 20%? All figures are in billions of dollars.Consolidated Balance Sheet: Chartered Banking System

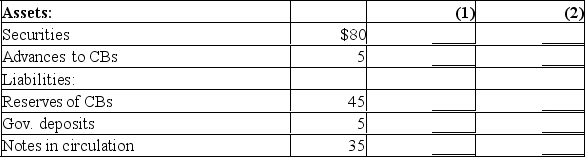

Consolidated Balance Sheet: Bank of Canada

Consolidated Balance Sheet: Bank of Canada

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional $2 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $3 billion of government bonds from the public.Show the new balance sheet figures in column 2.

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional $2 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $3 billion of government bonds from the public.Show the new balance sheet figures in column 2.

Definitions:

President

The elected head of state and government in a republic, responsible for implementing and enforcing laws written by the legislature and, often, also has the role of commander-in-chief of the armed forces.

Impeached and Convicted

The process and outcome where a public official is charged with misconduct and subsequently found guilty by a legislative body, leading to their removal from office.

Resigned

The act of formally giving up a position or office, often in a professional context.

Died in Office

Refers to officials or leaders who passed away while still holding their elected or appointed positions.

Q2: Explain the relationship between the aggregate expenditures

Q5: Does the recent increase in the average

Q6: What domestic macroeconomic adjustments would be necessary

Q7: What is meant by the Liquidity Trap?

Q20: Identify the two major ways economic growth

Q40: Assume the level of investment is $12

Q47: Identify two key tools of monetary policy.

Q91: Refer to the production possibilities curves.The movement

Q150: Which of the following will shift the

Q171: Marginal analysis means that decision-makers compare the