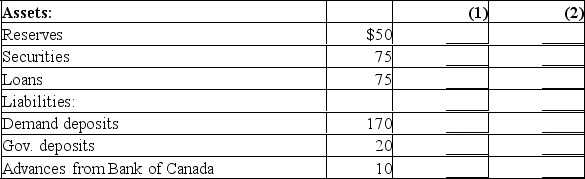

The following are simplified balance sheets for the chartered banking system and the Bank of Canada.Perform the two following transactions, (1) and (2), making appropriate changes in columns (1) and (2) in each balance sheet.Do not cumulate your answers.Also, answer these three questions for each part: (a) What change, if any, took place in the money supply as a direct result of this transaction? (b) What change, if any, occurred in chartered bank reserves? (c) What change occurred in the money-creating potential of the chartered banking system if the reserve ratio is 20%? All figures are in billions of dollars.Consolidated Balance Sheet: Chartered Banking System

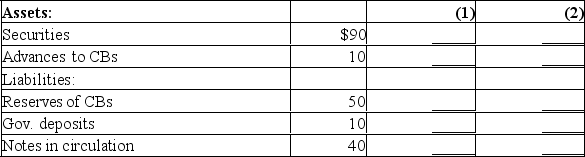

Consolidated Balance Sheet: Bank of Canada

Consolidated Balance Sheet: Bank of Canada

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional$3 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $2 billion of government bonds from the public.Show the new sheet figures in column 2.

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional$3 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $2 billion of government bonds from the public.Show the new sheet figures in column 2.

Definitions:

Click-on Agreement

A legal agreement entered into by clicking on a button or link, typically online, to accept terms and conditions.

Binding

Describes an agreement, contract, or legal decision that is enforceable by law.

Enforceable Contract

An agreement between parties that is legally binding and may be upheld and compelled by law.

Mailbox Rule

A rule providing that an acceptance of an offer becomes effective on dispatch.

Q6: What is the difference between nominal and

Q8: Compare and contrast the short-run Phillips Curve

Q11: What is money and what important function

Q17: Explain this quote from Adam Smith: "It

Q33: Explain the importance of self-interest in the

Q37: What is inflation and how is it

Q76: You should decide to go to a

Q79: The process in which workers select specialized

Q83: _ helps avoid the problems posed by

Q203: A point inside the production possibilities curve