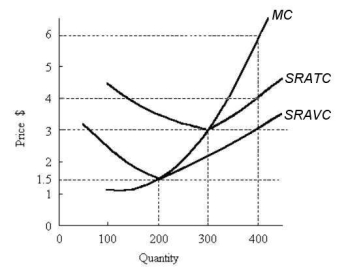

Consider the following short-run cost curves for a profit-maximizing firm in a perfectly competitive industry.  FIGURE 9-2

FIGURE 9-2

-Refer to Figure 9-2.If the current market price is $6,the profit-maximizing output for this firm is

Definitions:

Well-Diversified Portfolios

Investment portfolios that are spread across various assets to minimize exposure to any single asset or risk.

Arbitrage Opportunities

Situations in which it is possible to simultaneously buy and sell an asset or assets to profit from a difference in prices across different markets or formats without risk.

Expected Excess Return

The return on an investment over the risk-free rate of return that is anticipated based on risk assessment.

Beta Coefficient

A measure of a stock's volatility in relation to the overall market; a beta greater than 1 indicates more volatility than the market.

Q20: The central aim of an interest group

Q48: The increasing life span has led sociologists

Q50: If John consumes only two goods, A

Q52: One of the major reasons for dramatic

Q60: Refer to Table 7- 1. The economic

Q72: The fact that isoquants are downward sloping

Q89: Isocost lines are downward sloping straight lines,

Q92: Refer to Table 8- 2. As this

Q94: Refer to Table 9- 3. Suppose the

Q106: The market demand curve for a perfectly