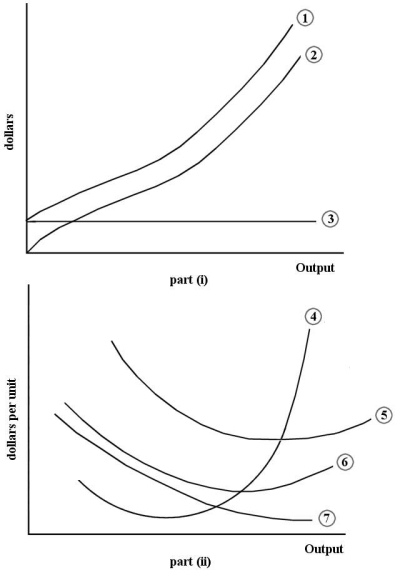

The diagram below shows some short- run cost curves for a firm.  FIGURE 7- 2

FIGURE 7- 2  4

4

-Refer to Figure 7- 2. Which of the following choices correctly identifies the cost curves in part (i) of the figure?

Definitions:

Futures Price

The agreed-upon price for the underlying asset in a futures contract to be paid at a future date.

Short Position

The futures trader committing to deliver the underlying asset.

S&P 500 Futures

Financial contracts that speculate on the future value of the S&P 500 index, allowing investors to predict and hedge against market movements.

Position

An investment holding or the amount of a particular security, commodity, or currency that an investor owns or has contracted to buy or sell.

Q8: Suppose a consumer can purchase only two

Q16: Government price controls<br>A) ensure that transactions take

Q30: The 1964 Civil Rights Act:<br>A) banned discrimination

Q37: Average revenue (AR) for an individual firm

Q44: Refer to Figure 8- 4. The firm

Q45: For a perfectly competitive firm in long-

Q62: When a plant is operating at the

Q81: A firm's short- run marginal cost curve

Q90: If consumption of a good generates a

Q101: Refer to Figure 5- 1. If the