FIGURE 5- 3

FIGURE 5- 3

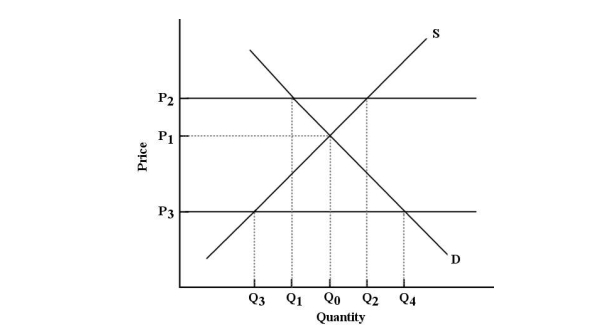

-Refer to Figure 5- 3. P3 represents a price imposed by the government. The result would be

Definitions:

Progressive

A political and social philosophy advocating for reform and improvements in social justice, welfare, and the protection of civil liberties.

Regressive

A term describing a tax system where the tax rate decreases as the taxable amount increases, disproportionately affecting those with lower incomes.

Payroll Tax

Taxes imposed on employers and employees, calculated as a percentage of the salaries that employers pay their staff.

Federal Personal Income Tax

A tax levied by the federal government on the yearly income of individuals, with the rate applied varying according to the income level.

Q20: If per capita income increases by 10

Q29: Given a particular consumer's indifference map, the

Q40: Refer to Table 6- 1. If the

Q68: If the demand for some good fluctuates,

Q69: A binding price floor is a<br>A) minimum

Q72: Suppose Statistics canada reports that total income

Q90: If consumption of a good generates a

Q112: Many people argue that the imposition of

Q112: If household expenditures on electricity remain constant

Q113: Which of the following statements about a