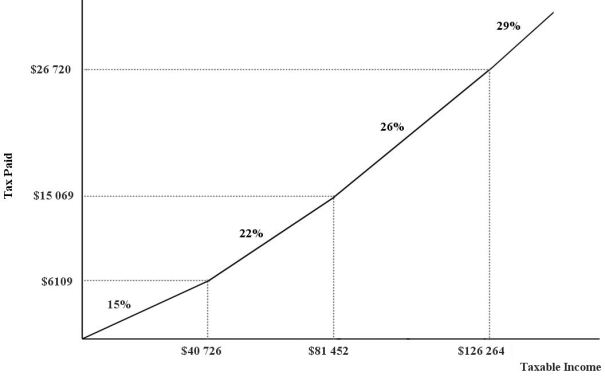

The figure below shows a simplified version of the current Canadian federal income- tax system. The marginal income- tax rates for the four ranges of income are 15 percent, 22 percent, 26 percent, and 29 percent, respectively.  FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2. What needs to be true about the four marginal income- tax rates in order for this tax system to be considered regressive?

Definitions:

All You Can Eat

A dining option where customers can consume as much food as they wish for a fixed price.

Portion Sizes

The amount of a particular food served or consumed in one eating occasion.

Socially Accepted

Behaviors, beliefs, or norms that are widely approved or tolerated by society.

Self-Esteem

Self-esteem is an individual's subjective evaluation of their own worth, encompassing beliefs and emotions regarding self-confidence and self-respect.

Q18: The North American Free Trade Agreement (NAFTA)

Q23: A typical firm hiring in a perfectly

Q35: Using the scientific method to approach an

Q43: A free- market economy with perfect allocative

Q56: If the annual rate of interest is

Q73: Economists generally agree that government intervention in

Q74: In terms of human capital, which of

Q79: Refer to Figure 34- 4. Suppose the

Q83: Refer to Figure 33- 1. Before any

Q93: Refer to Table 17- 1. Suppose a