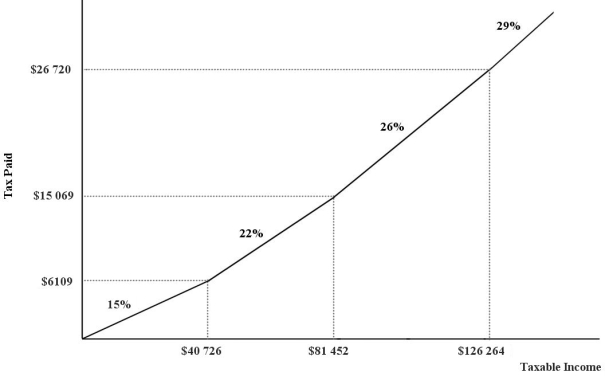

The figure below shows a simplified version of the current Canadian federal income- tax system. The marginal income- tax rates for the four ranges of income are 15 percent, 22 percent, 26 percent, and 29 percent, respectively.  FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2. This income- tax system can be characterized as

Definitions:

Researchers Responsibility

The ethical obligation of researchers to conduct studies honestly, transparently, and with respect for the welfare of participants and the community at large.

Multidimensional

Having or pertaining to multiple facets, aspects, or dimensions, often used to describe complex phenomena or attributes.

Areas of Development

Various domains in which an individual grows and matures, including physical, cognitive, emotional, and social development.

Case Study

An in-depth examination of a single individual (or small group of individuals).

Q5: Suppose a firm buys $3000 worth of

Q30: Refer to Figure 14- 6. If a

Q35: A paper mill discharges chemicals into a

Q40: A country that engages in no foreign

Q49: Refer to Figure 13- 1. On the

Q56: Consider a coal- fired electric- power plant

Q70: Refer to Figure 34- 3. If the

Q82: Refer to Figure 33- 5. If Paperland

Q91: Suppose there is a competitive market for

Q103: It is inefficient for the government to