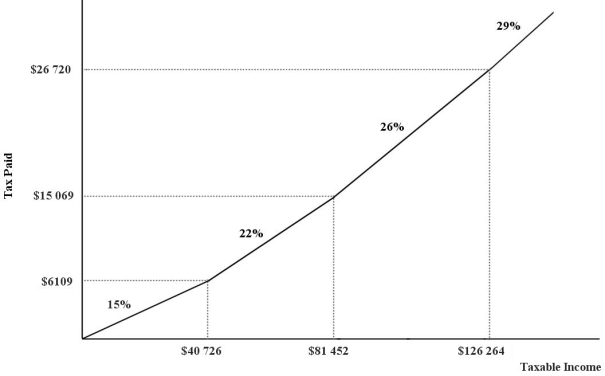

The figure below shows a simplified version of the current Canadian federal income- tax system. The marginal income- tax rates for the four ranges of income are 15 percent, 22 percent, 26 percent, and 29 percent, respectively.  FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2. An individual with a taxable income of $39 500 will pay in income taxes.

Definitions:

Corporate Misbehavior

Describes unethical or illegal actions taken by companies or their representatives.

Corporate Management

Corporate management involves the processes, strategies, and decisions employed in directing and controlling the operations of a corporation to achieve its objectives and maximize shareholder value.

Labor Unions

Organizations formed by workers to protect their rights and interests in their employment.

Justice Theorist

A scholar or philosopher who studies the principles of justice, exploring concepts such as fairness, equality, and moral rightness in society.

Q35: Refer to Figure 14- 4. Compared to

Q40: Refer to Table 14- 1. In a

Q49: Refer to Figure 34- 3. If Canada

Q62: Suppose economists at the World Bank discover

Q64: Data collected repeatedly over successive periods of

Q70: Quantity demanded is a flow variable, which

Q89: Refer to Figure 16- 1. Suppose that

Q100: When designing a policy to reduce polluting

Q107: A mandatory health- insurance premium of a

Q112: Refer to Figure 3- 2. A shift