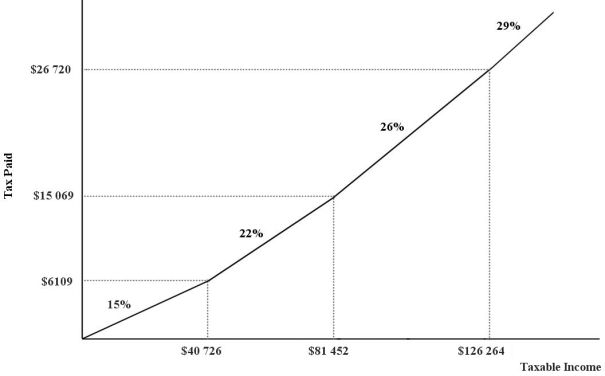

The figure below shows a simplified version of the current Canadian federal income- tax system. The marginal income- tax rates for the four ranges of income are 15 percent, 22 percent, 26 percent, and 29 percent, respectively.  FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2. An individual with a taxable income of $98 125 will pay $ in income taxes.

Definitions:

Q20: A plausible example of market failure due

Q34: Suppose an income tax is levied in

Q41: Refer to Table 33- 4. Compared with

Q45: Which of the following would cause a

Q51: The Canadian federal government's system of "equalization

Q52: Refer to Figure 33- 2. The diagrams

Q87: An agreement among a group of countries

Q89: In Canada, taxes are levied and collected

Q90: One region is said to have an

Q99: Refer to Table 33- 4. The opportunity