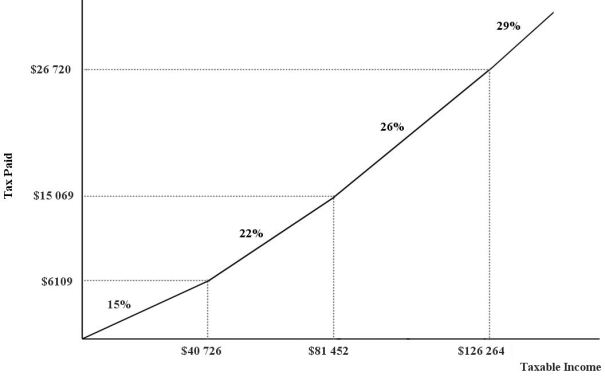

The figure below shows a simplified version of the current Canadian federal income- tax system. The marginal income- tax rates for the four ranges of income are 15 percent, 22 percent, 26 percent, and 29 percent, respectively.  FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2. What needs to be true about the four marginal income- tax rates in order for this tax system to be considered regressive?

Definitions:

Behavioral Principles

Fundamental ideas in psychology that explain how individual behavior is learned and maintained.

Physical Punishment

The use of physical force with the intention of causing a child to experience pain, but not injury, for the purpose of correction or control of behavior.

Perfect Attendance

The achievement of being present at every required instance, such as school or work, without any absences.

Negative Consequences

Unfavorable or harmful outcomes resulting from an action or decision.

Q2: The base year for an index number

Q2: One part of the "informal defence" of

Q6: The federal corporate income tax in Canada

Q18: The North American Free Trade Agreement (NAFTA)

Q36: Which of the following statements is NOT

Q51: The division of the gains of trade

Q85: Refer to Table 18- 1. If an

Q87: With a given upward- sloping supply curve

Q88: In recent years, some business schools in

Q90: Choose the best reason for a rightward