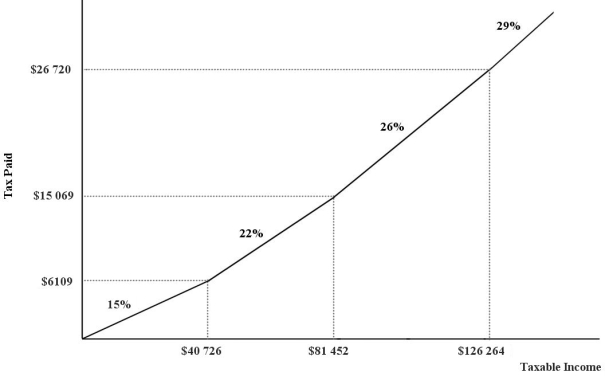

The figure below shows a simplified version of the current Canadian federal income- tax system. The marginal income- tax rates for the four ranges of income are 15 percent, 22 percent, 26 percent, and 29 percent, respectively.  FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2. This income- tax system can be characterized as

Definitions:

Expected Value

The predicted value of a variable, calculated as a sum of all possible values each multiplied by the probability of its occurrence.

Insurance Policy

A contractual agreement between an individual or entity and an insurance company, outlining the terms for the insurer to compensate the insured for specific losses in exchange for premiums paid.

Premium

An amount paid in addition to a standard price, often for insurance, or a higher or more privileged level of service or product.

Expected Value

A calculated average of all possible outcomes of a particular random variable, weighted by their respective probabilities.

Q5: Trade, whether between individuals or nations, generally

Q18: Carol can borrow $13 000 to buy

Q32: An index number expresses the value of

Q34: Refer to Figure 2- 4. This non-

Q35: Using the scientific method to approach an

Q51: On a coordinate graph, what is the

Q77: According to David Ricardo's principle of comparative

Q101: When a firm sells its product abroad

Q103: An agreement among a group of countries

Q104: The relevant objective in designing a tax