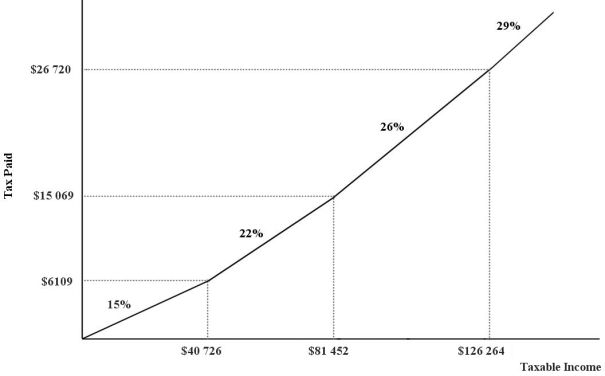

The figure below shows a simplified version of the current Canadian federal income- tax system. The marginal income- tax rates for the four ranges of income are 15 percent, 22 percent, 26 percent, and 29 percent, respectively.  FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2. An individual with a taxable income of $98 125 will pay $ in income taxes.

Definitions:

Absorption Costing

A product costing technique that assigns all costs of production (both variable and fixed) to the product, including overheads, to calculate its full cost.

Fixed Manufacturing Overhead

Costs that remain constant in total within manufacturing operations, regardless of the level of production, such as factory rent or salaries of permanent staff.

Traceable Fixed Expenses

Fixed costs that can be directly linked to a specific cost object, such as a department or product.

Net Operating Income

A company's gross income minus operating expenses, excluding taxes and interest charges, giving insight into the operational efficiency of the company.

Q7: The main point about public choice theory

Q19: The use of emissions taxes as a

Q23: The effect of a tariff on a

Q65: How much would you have to deposit

Q76: The slope of a curve is<br>A) negative

Q78: The "law of demand" hypothesizes that, other

Q87: If a negative externality is associated with

Q91: Refer to Figure 13- 2. This firm's

Q104: If at a particular wage rate in

Q110: In order to test a theory, one