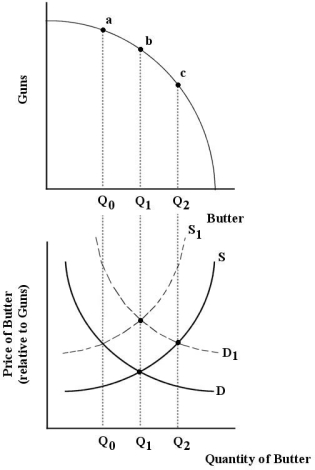

The production possibilities boundary shows possible combinations of guns and butter that can be produced by a country. The lower diagram shows demand and supply for butter.  FIGURE 12- 2

FIGURE 12- 2

-Refer to Figure 12- 2. Suppose demand and supply for butter are shown by D and S, respectively. And suppose the economy is at point (a) on the production possibilities boundary. How can this economy move toward allocative efficiency?

Definitions:

Deferred Taxes

Taxes that are incurred in one period but are not paid until a future period, often due to timing differences between accounting and tax reporting.

Taxable Entity

A business or individual that is required to pay taxes to a federal, state, or local government.

Permanent Difference

These are differences between taxable income and accounting income that originate in one period and do not reverse over time, affecting taxable income and tax liability.

Temporary Difference

A discrepancy between the tax base of an asset or liability and its carrying amount on the balance sheet that results in taxable or deductible amounts in future years.

Q17: What price considerations should be included in

Q42: A monopolistically competitive firm is predicted to

Q49: One similarity between a monopoly and a

Q59: In writing the targeting portion of the

Q61: Suppose market E discriminates against one group

Q63: A company's tendency toward offensive or defensive

Q76: Which of the following is an incorrect

Q83: The existence of imperfectly competitive firms implies

Q86: Refer to Figure 14- 2. Suppose the

Q122: The marginal revenue product curve for a