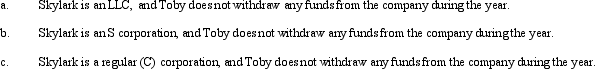

During the current year,Skylark Company had operating income of $420,000 and operating expenses of $250,000.In addition,Skylark had a long-term capital loss of $20,000,and a charitable contribution of $5,000.How does Toby,the sole owner of Skylark Company,report this information on his individual income tax return under following assumptions?

Definitions:

Q4: Jon owns an apartment building in which

Q10: (Same facts as Question 1).Once John removes

Q11: Discuss the effect of a liability assumption

Q12: When the grand jury approves further prosecution,they

Q13: Part of the investigation of a rape

Q64: A taxpayer may never recognize a loss

Q104: A nonbusiness bad debt can offset an

Q119: Which of the following events causes the

Q153: Carlton purchases land for $550,000.He incurs legal

Q215: Paul sells property with an adjusted basis