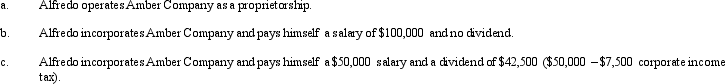

Amber Company has $100,000 in net income in 2013 before deducting any compensation or other payment to its sole owner,Alfredo.Assume that Alfredo is in the 33% marginal tax bracket.Discuss the tax aspects of each of the following independent arrangements.(Assume that any salaries are reasonable in amount and ignore any employment tax considerations.)

Definitions:

Social Influence Bias

The effect that the opinions, behaviors, or actions of others have on an individual's decisions, often impacting trends and consumer choices.

Focus Groups

A research method that gathers feedback, opinions, and attitudes from a small, diverse group of people participating in a guided discussion.

Avoid Conflict

The act of steering clear of disagreements and disputes, often to maintain harmony and prevent escalation in professional or personal contexts.

Q7: Another term for jury selection is<br>A)grand jury.<br>B)respondeat

Q10: In which of the following scenarios is

Q11: The term for the person who actually

Q13: Jack is known for being a bully

Q16: Jane is at a party and has

Q18: Flycatcher Corporation,a C corporation,has two equal individual

Q59: Vertical,Inc.,has a 2013 net § 1231 gain

Q78: Chris receives a gift of a passive

Q104: Lola owns land as an investor.She exchanges

Q114: Eunice Jean exchanges land held for