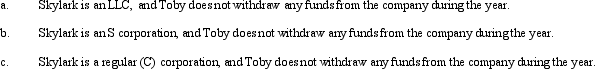

During the current year,Skylark Company had operating income of $420,000 and operating expenses of $250,000.In addition,Skylark had a long-term capital loss of $20,000,and a charitable contribution of $5,000.How does Toby,the sole owner of Skylark Company,report this information on his individual income tax return under following assumptions?

Definitions:

Masculinity

A set of attributes, behaviors, and roles traditionally associated with boys and men, often culturally defined.

Machismo

A cultural attitude or practice that emphasizes masculine pride and the domination of women, often associated with Latin American societies.

Bureau of Justice Statistics

A U.S. government agency responsible for collecting, analyzing, and publishing statistical data on crime, criminal offenders, victims of crime, and the operation of justice systems at all levels of government.

Sexual Abuse

The coercion or force of an individual to engage in sexual activities without consent, covering a range of behaviors from sexual assault to harassment.

Q12: In order to prove rape,the prosecution must

Q13: The jury imposes the sentence on the

Q14: In order to receive the death penalty,a

Q16: Before defendants can raise many affirmative defenses,such

Q17: Vanna owned an office building that had

Q19: Which of the following are money, and

Q45: Short-term capital losses are netted against long-term

Q83: The chart below describes the § 1231

Q91: Discuss the logic for mandatory deferral of

Q115: On June 1,2013,Brady purchased an option to