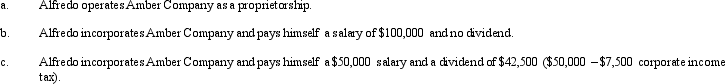

Amber Company has $100,000 in net income in 2013 before deducting any compensation or other payment to its sole owner,Alfredo.Assume that Alfredo is in the 33% marginal tax bracket.Discuss the tax aspects of each of the following independent arrangements.(Assume that any salaries are reasonable in amount and ignore any employment tax considerations.)

Definitions:

Promise

An assurance given by one party to another, agreeing to do or not do something specified in the future.

Consideration

Consideration is a fundamental principle in contract law, referring to something of value exchanged between parties as part of an agreement.

Legal Value

Consideration or benefit recognized by law as sufficient to form a valid contract or enforceable obligation.

Gross Inadequacy

An extreme lack of sufficiency or competence in performance or provision, often referenced in legal contexts concerning contractual or fiduciary obligations.

Q2: The definition of legal insanity is that

Q3: Police arrive at the scene of a

Q6: The death penalty can be imposed in

Q11: A suspect's skin and blood are discovered

Q34: Rachel owns 100% of the stock of

Q64: Peggy is in the business of factoring

Q77: Joyce owns an activity (not real estate)in

Q113: Similar to like-kind exchanges,the receipt of "boot"

Q143: Mitch owns 1,000 shares of Oriole Corporation

Q204: Arthur owns a tract of undeveloped land