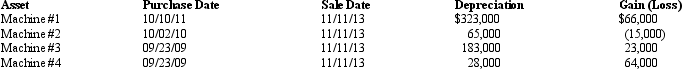

A business taxpayer sold all the depreciable assets of the business,calculated the gains and losses,and would like to know the final character of those gains and losses.The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets.The taxpayer had unrecaptured § 1231 lookback loss of $12,000.What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction.)

Definitions:

Calms Body

Actions or processes that result in a state of physical relaxation and reduced stress or anxiety.

Feelings Of Irritation

Emotional responses characterized by mild anger or annoyance often triggered by frustration.

Airport

A facility for the landing, takeoff, and maintenance of civil aircraft, with services and facilities for passengers and cargo.

Personal Control

The extent to which an individual feels they can influence or direct events affecting their life, often associated with positive mental health outcomes.

Q1: As a general rule,the government has twice

Q6: In some states,the category of accessory has

Q21: Beth sells investment land (adjusted basis of

Q41: Hans purchased a new passenger automobile on

Q48: For § 351 purposes,stock rights and stock

Q51: On June 1,2013,Red Corporation purchased an existing

Q53: In 2013,Joanne invested $90,000 for a 20%

Q69: An individual has the following recognized gains

Q113: An accrual basis taxpayer accepts a note

Q163: The amount received for a utility easement