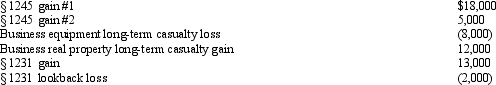

Betty,a single taxpayer with no dependents,has the gains and losses shown below.Before considering these transactions,Betty has $45,000 of other taxable income.What is the treatment of the gains and losses and what is Betty's taxable income?

Definitions:

Critical Insights

In-depth observations or analyses that offer profound understanding or novel perspectives on a complex issue.

Human Nature

The inherent characteristics, including cognitive, social, and emotional aspects, that are considered typical of humanity.

Alternative Approaches

Different methods or techniques used in a field, particularly when they diverge from traditional or mainstream methodologies.

Study of Personality

The academic and scientific investigation into the characteristics, behaviors, and psychological processes that comprise human individuality.

Q2: In order to establish the value of

Q25: Jed is an electrician.Jed and his wife

Q28: Which of the following is correct?<br>A)The gain

Q79: Jake,the sole shareholder of Peach Corporation,a C

Q94: Short-term capital gain is eligible for a

Q98: Tonya had the following items for last

Q112: Gains and losses on nontaxable exchanges are

Q140: During the current year,Gray Corporation,a C corporation

Q142: The basis of property acquired in a

Q180: A taxpayer who sells his or her