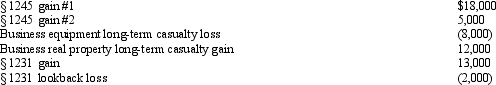

Betty,a single taxpayer with no dependents,has the gains and losses shown below.Before considering these transactions,Betty has $45,000 of other taxable income.What is the treatment of the gains and losses and what is Betty's taxable income?

Definitions:

Organizing Icon

A graphical symbol used to represent the function of organizing or arranging files, folders, or digital information.

Desktop

The primary user interface of a computer's operating system, featuring icons, windows, and background wallpaper.

Icon

A small graphical symbol or image that represents a program, function, data, or file in a computer interface.

Program

A sequence of instructions written to perform a specified task with a computer.

Q2: During his interrogation,police offer to speak with

Q4: What are the sanctions for an improper

Q55: In computing the amount realized when the

Q73: The cost of depreciable property is not

Q77: To ease a liquidity problem,all of the

Q112: Which of the following creates potential §

Q115: On June 1,2013,Brady purchased an option to

Q119: For the loss disallowance provision under §

Q144: If more than 40% of the value

Q207: If the fair market value of the