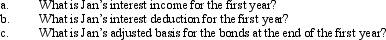

Jan purchases taxable bonds with a face value of $250,000 for $265,000.The annual interest paid on the bonds is $10,000.Assume Jan elects to amortize the bond premium.The total premium amortization for the first year is $1,600.

Definitions:

Surgical Asepsis

A set of sterile practices and procedures used to eliminate all microbial life, including spores, from an area or object, crucial in surgical and certain medical procedures to prevent infection.

Sterile Package

Packaging that has been treated to ensure it's free from all living microorganisms to maintain cleanliness and prevent infection.

Type I Hypersensitivity

An immediate allergic reaction caused by the release of histamine from mast cells, often manifesting as anaphylaxis or asthma.

Tachycardia

An abnormally rapid heart rate, typically defined as a resting heart rate over 100 beats per minute.

Q16: ASC 740 (FIN 48)addresses how an entity

Q29: Adrian is the president and sole shareholder

Q36: A theft loss is taken in the

Q52: If a transaction qualifies under § 351,any

Q71: Tan Corporation desires to set up a

Q112: Percentage depletion enables the taxpayer to recover

Q114: On January 18,2012,Martha purchased 200 shares of

Q127: Double taxation of corporate income results because

Q142: Adam transfers cash of $300,000 and land

Q228: Hilary receives $10,000 for a 7-foot wide