Essay

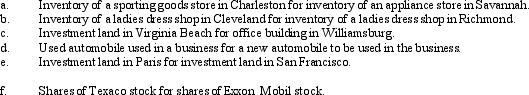

For the following exchanges,indicate which qualify as like-kind property.

Definitions:

Related Questions

Q6: Clipp,Inc.,earns book net income before tax of

Q18: Ben sells stock (adjusted basis of $25,000)to

Q22: In applying the $1 million limit on

Q39: Kate dies owning a passive activity with

Q56: Moss exchanges a warehouse for a building

Q71: A business machine purchased April 10,2011,for $98,000

Q120: Last year,Ted invested $100,000 for a 50%

Q143: Mitch owns 1,000 shares of Oriole Corporation

Q190: In 2013,Fran receives a birthday gift of

Q202: Why is it generally undesirable to pass