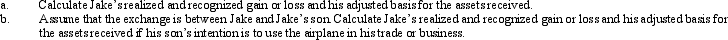

Jake exchanges an airplane used in his business for a smaller airplane to be used in his business.His adjusted basis for the airplane is $325,000 and the fair market value is $310,000.The fair market value of the smaller airplane is $300,000.In addition,Jake receives cash of $10,000.

Definitions:

Longitudinal Growth

The increase in length of bones due to the activity in the epiphyseal plates, which contributes to overall height during development.

Epiphyseal Plate

The growth plate located at the end of long bones, responsible for longitudinal growth.

Chondroblasts

Cells that actively produce the components of the extracellular matrix, leading to the formation of cartilage tissue.

Growth Spurt

A growth spurt refers to a rapid increase in height and weight that typically occurs during puberty.

Q10: Benita incurred a business expense on December

Q15: Generally,a closely-held family corporation is not permitted

Q18: When a defendant is found not guilty

Q20: In 2012,Jenny had a $12,000 net short-term

Q53: Under GAAP,a corporation can defer reporting the

Q75: If investment property is stolen,the amount of

Q92: Cason is filing as single and has

Q113: Similar to like-kind exchanges,the receipt of "boot"

Q119: For the loss disallowance provision under §

Q151: Wyatt sells his principal residence in December