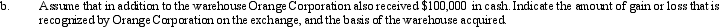

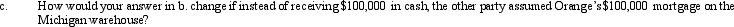

a. Orange Corporation exchanges a warehouse located in Michigan (adjusted basis of $560,000)for a warehouse located in Ohio (adjusted basis of $450,000; fair market value of $525,000).Indicate the amount of gain or loss that is recognized by Orange Corporation on the exchange,and the basis of the warehouse acquired.

Definitions:

Q6: The death penalty can be imposed in

Q17: Rob and Fran form Bluebird Corporation with

Q41: Hans purchased a new passenger automobile on

Q41: Which of the following events would produce

Q69: Mona purchased a business from Judah

Q75: Section 1231 property includes nonpersonal use property

Q79: The chart below details Sheen's 2011,2012,and

Q103: Last year,Amos had AGI of $50,000.Amos also

Q121: Lilac Corporation incurred $4,700 of legal and

Q162: Paula is the sole shareholder of Violet,Inc.For