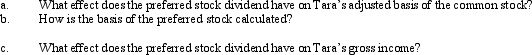

Tara owns common stock in Taupe,Inc.,with an adjusted basis of $250,000.She receives a preferred stock dividend which is nontaxable.

Definitions:

Feet Support

The provision of adequate cushioning, alignment, and comfort for the feet, often through specialized footwear or orthotics, to prevent or mitigate pain and injury.

Sitting Position

A posture where the weight of the body is supported by the buttocks rather than the feet and is common in many daily activities.

Metabolic Alteration

Changes in the body's metabolic processes, which can affect how it converts food and oxygen into energy.

Immobility

Inability to move about freely; caused by any condition in which movement is impaired or therapeutically restricted.

Q6: The tax concept and economic concept of

Q7: In some cases,when defendants are charged with

Q13: The effects of a below-market loan for

Q40: Joyce,a farmer,has the following events occur during

Q52: Mel was the beneficiary of a $45,000

Q61: Ruth transfers property worth $200,000 (basis of

Q65: Phyllis,Inc.,earns book net income before tax of

Q73: Similar to the like-kind exchange provision,§ 351

Q74: A nonbusiness bad debt is a debt

Q133: In Lawrence County,the real property tax year