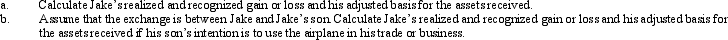

Jake exchanges an airplane used in his business for a smaller airplane to be used in his business.His adjusted basis for the airplane is $325,000 and the fair market value is $310,000.The fair market value of the smaller airplane is $300,000.In addition,Jake receives cash of $10,000.

Definitions:

Variable Overhead Efficiency Variance

The difference between the actual variable overhead incurred and the expected variable overhead based on standard cost for the actual level of activity.

Performance Evaluation

The process of assessing the effectiveness and efficiency of individuals, teams, or systems within an organization.

Budgets

Financial plans that estimate income and expenditures for a specific period of time, often used by businesses and individuals for planning purposes.

Budgeting Process

A systematic approach to estimating the financial performance and resource requirements of a business for a future period, typically involving setting goals and preparing detailed plans.

Q25: On January 1,2013,Faye gave Todd,her son,a 36-month

Q29: Adrian is the president and sole shareholder

Q69: In January 2013,Tammy purchased a bond due

Q83: If Wal-Mart stock increases in value during

Q91: In the case of a gift loan

Q108: Jessica is a cash basis taxpayer.When Jessica

Q113: Lucy owns and actively participates in the

Q136: Under the taxpayer-use test for a §

Q149: The maximum amount of the § 121

Q209: Kevin purchased 5,000 shares of Purple Corporation